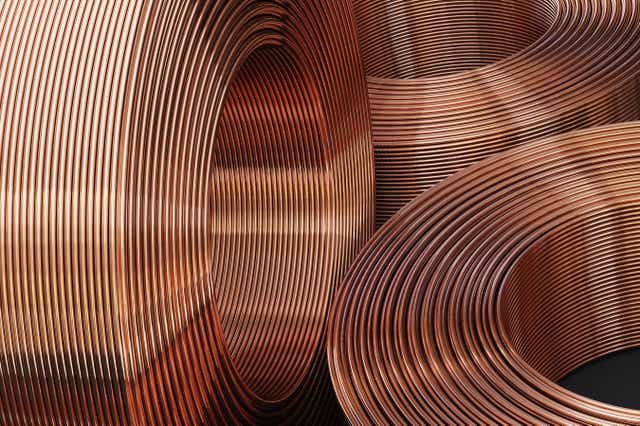

Oil prices experienced a surge on Friday as concerns over a potential attack by Iran on Israel loomed, raising fears of an escalated conflict in the Middle East that could impact oil supplies. Despite reaching six-month intraday highs, prices ultimately ended the week with losses due to rising U.S.crude stocks and higher-than-expected inflation.

BOK Financial's Dennis Kissler noted that there was significant upward pressure on futures prices due to increased option call buying ahead of the weekend. With Iran's production estimated at 3 million barrels per day, any disruption in supply could quickly tighten the supply/demand balance.

Manish Raj from Velandera Energy Partners highlighted Iran's ability to block the Strait of Hormuz as a potential threat, but Tom Kloza of OPIS Global cautioned against actions that could harm Iranian exports. Despite the geopolitical risks, crude oil prices closed higher on Friday at $85.66 per barrel for Nymex crude and $90.45 per barrel for Brent crude.

In contrast, natural gas prices remained relatively stable, with the front-month contract closing at $1.770/MMBtu.

The International Energy Agency's bearish monthly report predicting slower oil demand growth in 2024 and 2025 did little to deter market sentiment, with OPEC maintaining a more optimistic outlook for future demand.The energy sector, represented by the Energy Select Sector SPDR ETF, ended the week down 2%. While some energy and natural resources stocks saw significant gains, others experienced losses over the past five days.

English (US)

English (US)