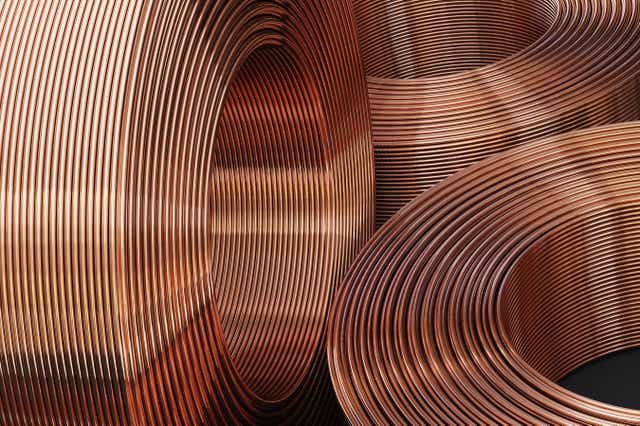

Renowned hedge fund manager Pierre Andurand, an expert in commodity trading, has expressed optimism about the future of copper prices. He believes that the current rally in copper prices still has room to grow and predicts that the price could nearly quadruple to $40K/metric ton in the coming years. Andurand anticipates that the demand for copper will outpace supply in the latter part of the decade, driving prices even higher.

In an interview with the Financial Times, Andurand highlighted the increasing demand for copper due to global electrification efforts, including the growing use of electric vehicles, solar panels, wind farms, military applications, and data centers. He sees these factors contributing to the continued rise in copper prices. While Andurand is bullish on commodities like aluminum, he does not expect significant increases in crude oil prices due to geopolitical risks affecting supply stability. Recent trends in the market saw a slight decline in U.S. copper futures after several weeks of gains, with gold and silver prices also experiencing decreases. Investor sentiment towards copper has shifted, influencing ETFs like CPER, COPX, JJCTF, GLD, and GDX, as demand growth in China slows despite rising global demand for copper.Top commodity trader Andurand predicts quadruple increase in copper prices due to soaring demand

6 months ago

1741

6 months ago

1741

- Homepage

- Business & Finance

- Top commodity trader Andurand predicts quadruple increase in copper prices due to soaring demand

Related

Iconic Musician Bob Dylan's Rare Abstract Painting Sells for...

6 months ago

1504

Judge Rules Against Foreclosure Auction of Elvis Presley's G...

6 months ago

1505

Oil prices dip after initial rise following death of Iran's ...

6 months ago

1614

Trending in United States of America

Popular

Disney's Major Investment in Epic Games Signals Next Chapter...

8 months ago

1804

Top commodity trader Andurand predicts quadruple increase in...

6 months ago

1740

Middle East tension boosts Brent crude above $90 for the fir...

7 months ago

1734

World of Warcraft Companion App to be Discontinued by Blizza...

7 months ago

1731

"Don't Take Travel for Granted: Tips for Traveling with Elde...

8 months ago

1728

© StoryBrut 2024. All rights are reserved

English (US)

English (US)